Deal Advisory

- M&A

- divestments

- joint ventures

- partnerships & strategic alliances

- management buyouts

- others

How can Agilience Asia Help?

Our professionals offer our clients the flexibility to customise our services to suit their needs in different stages of any M&A transactions, delivering impactful solutions through a multi-discliplinary mentality drawn from a diverse array of industry expertise.

Our Unparalleled Expertise and Unrivaled Approach

Hands On:

Industry Focused:

Flexible and Agile:

Client Centric:

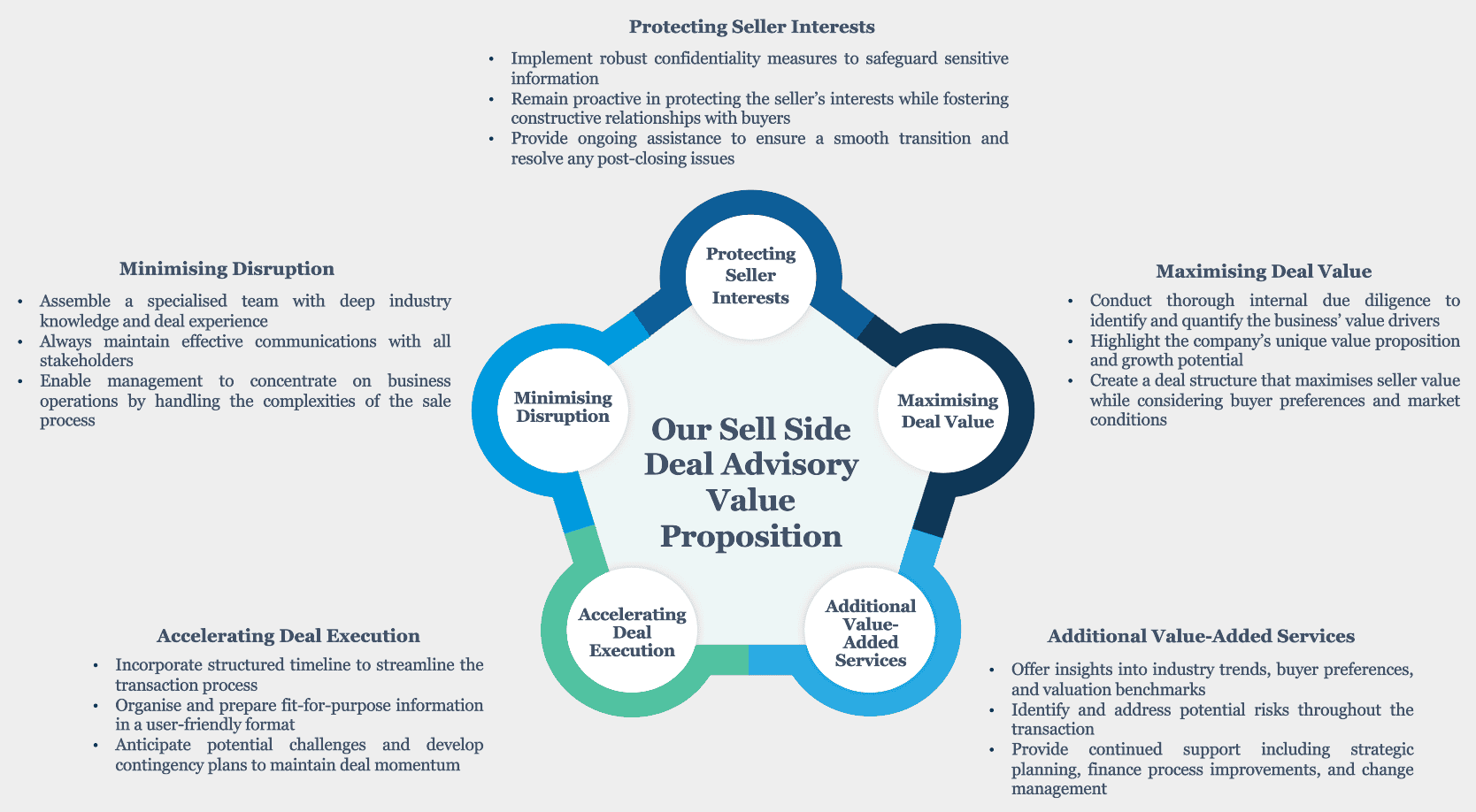

Sell Side & Asset Monetisation

Our Structured Approach to Deal Advisory Performance

Buy-Side/ Transaction Support

We deliver a comprehensive array of Buy-Side services to:

Public and Privately-Owned Corporations

Public Equity and Venture Capitals

Family Offices

Individual Investors

Others

FAQs

1. What are Deal Advisory services?

Deal Advisory services encompass a comprehensive range of strategic and financial support designed to assist businesses throughout the lifecycle of transactions. This includes evaluating, structuring, negotiating, and executing mergers, acquisitions, divestitures, joint ventures, and other significant business transactions.

2. How can Deal Advisory services benefit my business?

Deal Advisory services provide essential support by helping your business identify and evaluate potential opportunities, navigate complex transactions, and maximise value. We also work to minimise risks and business disruptions and ensure that transactions align with your strategic objectives, ultimately contributing to your long-term success.

3. How can your team assist in identifying potential M&A targets, strategic partners, or buyers?

At Agilience Asia, our experienced team draws on extensive network connections, industry expertise, and thorough market research to identify potential M&A targets, strategic partners, or buyers that align with your strategic objectives and criteria. This comprehensive approach ensures that we find opportunities that best support your business goals.